How to Refinance Your Weight Loss Surgery?

Refinancing is a good option for individuals who require money for their medical treatment, including weight loss surgery, and are dealing with shortage of finances.

Refinancing helps you rearrange the elements of your liabilities in an appropriate manner via which you can get hold of your finances. It also makes your repayment cycle more systematic and unambiguous.

Lose unwanted inches while saving big!

Request quoteA picture is worth a thousand words.

Apart from reaping the financial benefits check out how our patient regained her health.

Before & After: Weight Loss Surgery in Mexico

What is Refinancing?

The process of refinancing will involve the following:

- A new debt will replace an old debt

- The new debt will pay off the old debt

- The collateral used for old loan will remain the same for the new loan as well

- The amount of monthly payments will change as per the total amount of the new loan and the rate of interest on it

Refinancing for Bariatric Surgery

Bariatric surgery is an expensive medical treatment and you might not have enough money to afford the same. Refinancing can help you arrange money for your weight loss surgery.

Weight loss surgery abroad in a medical tourism destination has come up as an attractive option because of its cost effectiveness. It gives you the option of getting your desired medical treatment at a fraction of the cost as compared to that in the U.S. and Canada.

If you are looking forward to getting weight loss surgery in Mexico, Costa Rica, or any other medical tourism destination but have shortage of funds, you can go for refinancing.

Advantages of Refinancing

- Low rate of interest: You can get a new loan for comparatively lower rate of interest.

- Pay off the old loan: The new loan will clear your old loan related liabilities.

- Merging of multiple debts: If you happen to have several debts, paying multiple instalments every month can be nerve-racking. To save the headache, you can replace all the old loans with a single new loan.

- Reducing the duration of loan: You might want to reduce the tenure of your existing loan(s). A new loan with a shorter repayment term can be opted for in such cases.1

Why Refinance for Your Bariatric Surgery?

If no other financial mode is working for you, refinancing is a great option for arranging money for your bariatric surgery. The reasons other financing options aren’t working out for you could be:

- You have a bad credit score because of default in instalment payment

- You already have multiple loans

- You do not qualify for Medicaid or government grants

- You do not have any assets to sell off to arrange money for your treatment

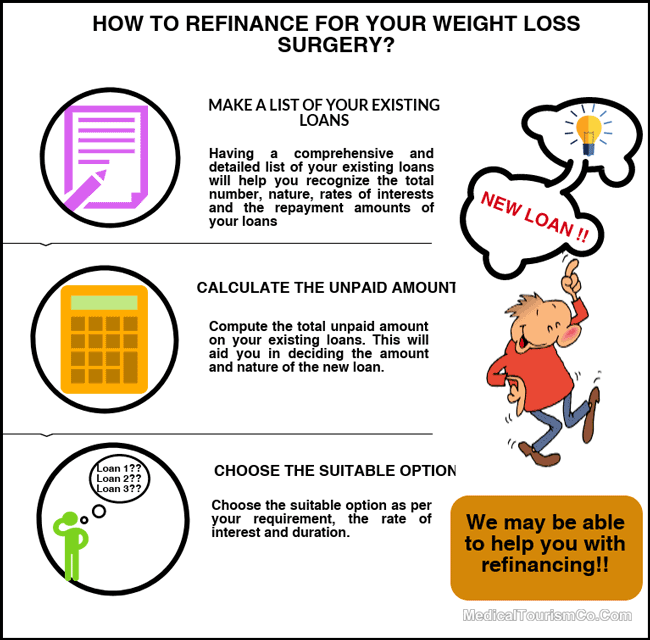

How to Refinance for WLS?

Refinancing is a hassle-free financing alternative. Here’s how to go about it:

- Make a list of your already existing loan(s)

- Check the unpaid amount of old loan

- Determine the cost of your gastric bypass or gastric sleeve surgery in Mexico or wherever you choose to have the procedure

- Apply for a new loan with the most suitable features

- The amount of the new loan should be higher than the old loan. This will repay the earlier debt and the extra amount can be used towards treatment

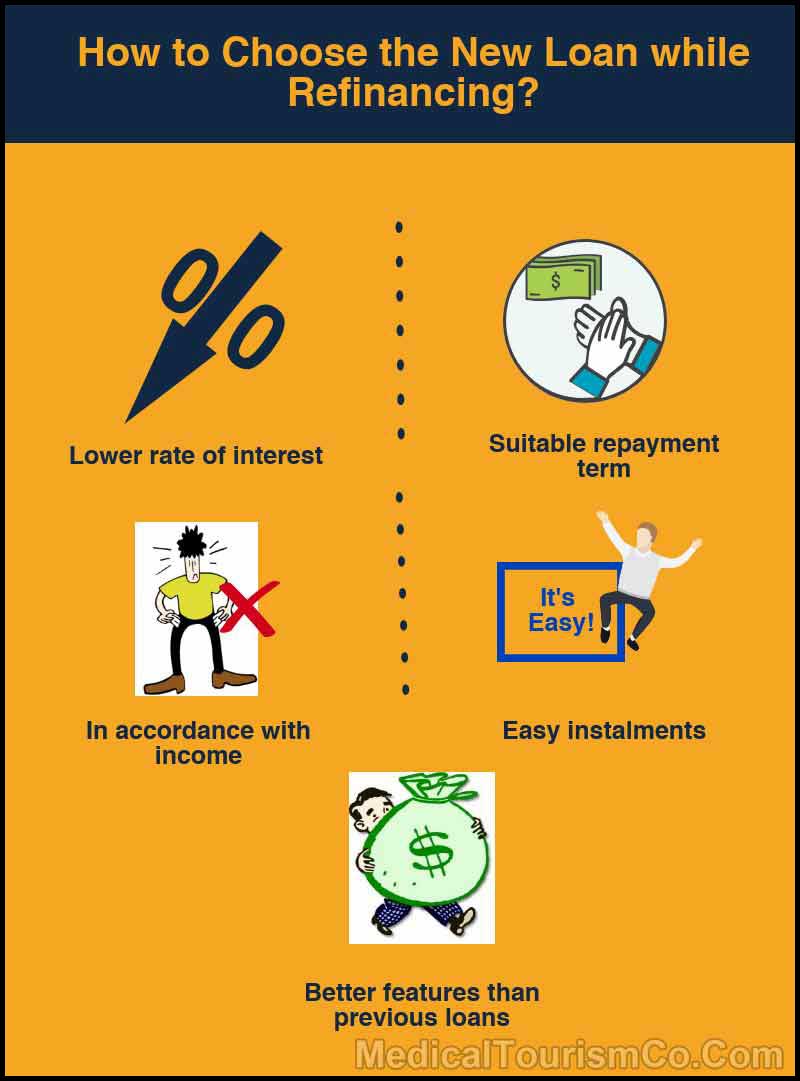

How to Choose New Loan While Refinancing?

-

- Try taking a loan with a lower rate of interest

- Chose a suitable loan term

- Avail an option as per your income

- Go for the option that has easy instalments

- Opt for the one that offers better features than the earlier one

Before applying for a loan, a good rule of thumb is to get quotes from all the prospective lenders. You should then compare the terms and conditions of all lenders and choose accordingly!2

Refinancing is a judicious choice for individuals who are unable arrange money for their medical treatment due to the burden of already existing multiple loans. It solves the dual purpose of getting rid of your old loan(s) and arrangement of finance for your bariatric surgery.

References

- Pritchard Justin (2016). Refinance Definitions and Examples, Available at: https://www.thebalance.com/what-is-refinancing-315633 [Accessed on 1 November 2017]

- Rounds Hannah, (2017). U.S. Mortgage Market Statistics: 2017, Retrieved on 12 February 2017 from: http://www.magnifymoney.com/blog/mortgage/u-s-mortgage-market-statistics-2017/